Claim:

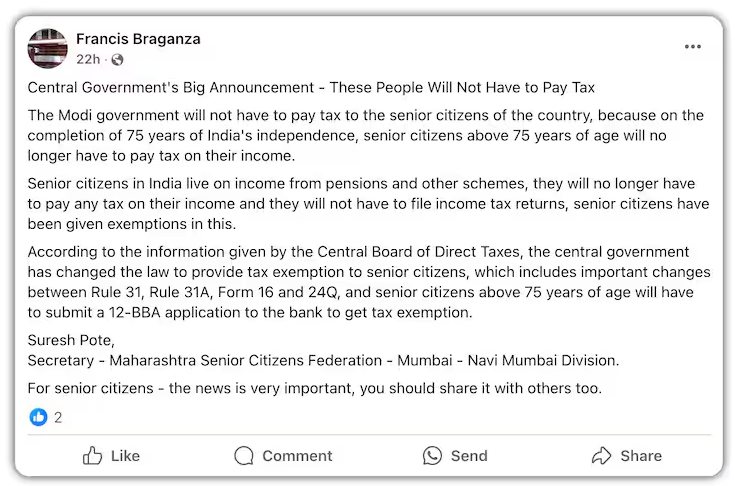

A viral social media message claims that senior citizens above 75 years of age will no longer have to pay income tax due to changes announced by the Modi government.

Verdict:

Misleading.

The Claim

A widely circulated post on social media asserts that senior citizens aged 75 and above are exempt from paying income tax. The message claims this change is part of a government initiative commemorating 75 years of India’s independence. It also mentions new procedures involving Rule 31, Form 16, and the 12-BBA application form for claiming tax exemption.

Fact-Check Analysis

1. No New Proposals for Tax Relief:

Minister of State for Finance Pankaj Choudhary recently informed Parliament that no new proposals for tax relief for senior citizens are being considered. This refutes the claim of any recent law or announcement exempting senior citizens above 75 from income tax.

2. PIB Fact Check:

The Press Information Bureau (PIB) issued a statement clarifying the matter. According to PIB Fact Check:

- Senior citizens above 75 years of age with only pension and interest income are exempt from filing Income Tax Returns (ITR) under Section 194P of the Income Tax Act, 1961.

- However, this does not mean they are exempt from paying taxes. Taxes, if applicable, are deducted by specified banks after computing eligible deductions.

3. Existing Tax Provisions:

Under current rules:

- Senior citizens (60-79 years) are exempt from tax on annual income up to ₹3,00,000.

- Super senior citizens (80 years and above) are exempt from tax on annual income up to ₹5,00,000.

- Section 194P offers relief by removing the requirement to file ITR for those aged 75 or above with only pension and interest income, provided taxes are deducted by the bank.

4. No Credible Announcements:

A thorough search of credible news outlets and official government notifications revealed no announcement regarding blanket tax exemptions for senior citizens above 75 years of age.

Context

The viral post misrepresents provisions under Section 194P of the Income Tax Act. This section, introduced in 2021, simplifies tax compliance for senior citizens by exempting them from filing returns if their income is limited to pensions and bank interest. The claim of full tax exemption for those above 75 years is a misinterpretation of this rule.

Conclusion

The viral claim suggesting complete income tax exemption for senior citizens aged 75 and above is misleading. While Section 194P simplifies tax filing for eligible senior citizens, it does not exempt them from paying taxes. Claims of broader tax relief are baseless, as confirmed by the Ministry of Finance and PIB Fact Check.

Verdict: Misleading.

hi!,I love your writing so so much! proportion we keep up a correspondence extra approximately your post on AOL? I require a specialist in this house to unravel my problem. May be that is you! Having a look ahead to see you.

The next time I read a blog, I hope that it doesnt disappoint me as a lot as this one. I imply, I know it was my choice to read, however I truly thought youd have one thing fascinating to say. All I hear is a bunch of whining about something that you might fix in the event you werent too busy looking for attention.

Hey there! This is my 1st comment here so I just wanted to give a

quick shout out and tell you I truly enjoy reading through your blog posts.

Can you recommend any other blogs/websites/forums that deal

with the same topics? Appreciate it!